child tax credit monthly payments continue in 2022

See what makes us different. The way it looks right now the increased child tax credits wont be continuing into 2022.

2021 Child Tax Credit Advanced Payment Option Tas

Whether that includes monthly payments and how many.

. If you have a child under the age of 18. Half of the credit -. Frequently asked questions about the tax year 2021filing season 2022 child tax credit.

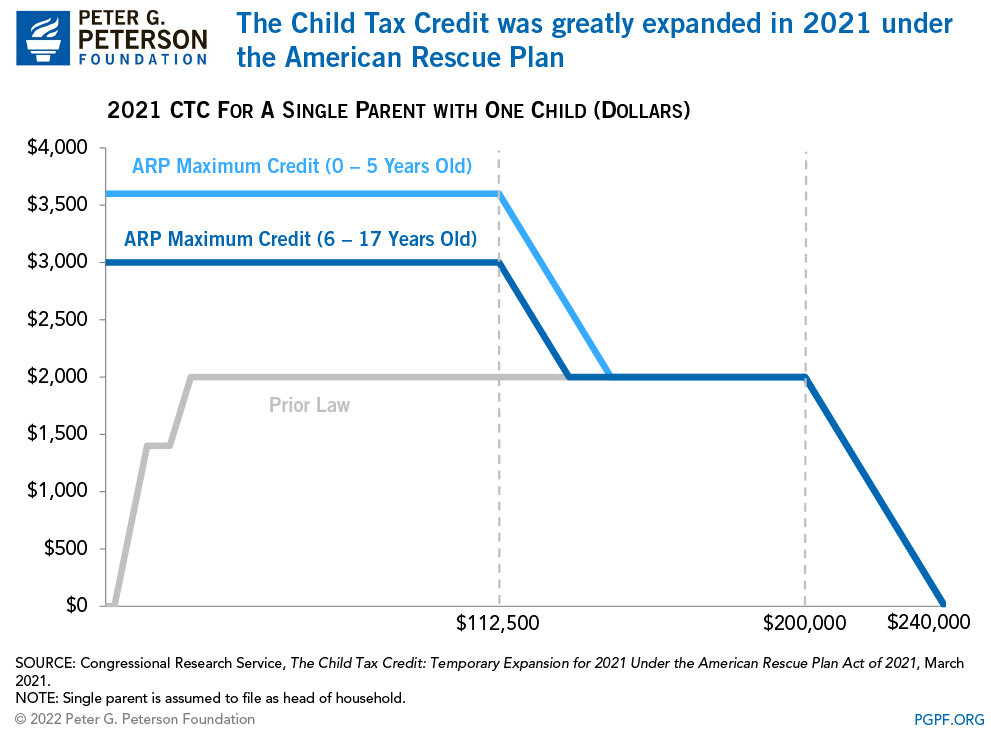

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. The short answer is NO since a funding extension for 2022 payments has not yet been approved by Congress. The credit will be continued through 2022 according to a framework of the now 175 trillion proposal by Democrats released last week.

Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. No monthly CTC. The child tax credit will continue in some form.

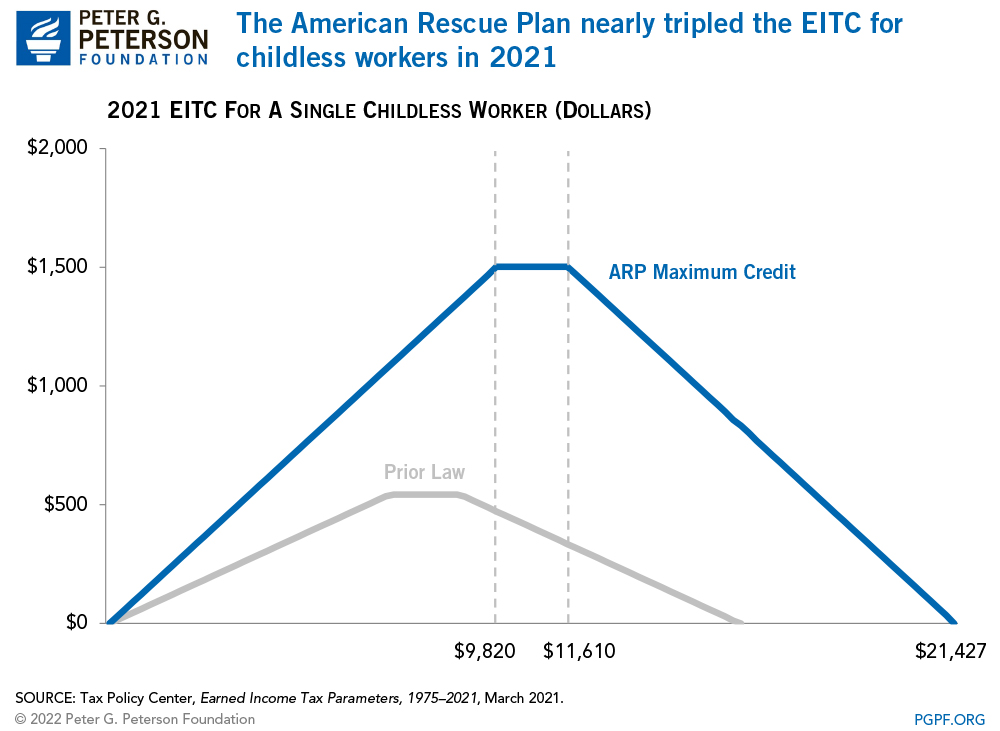

Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. Parents E-File to Get the Credits Deductions You Deserve. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Those who opted out of all. Current law clearly states that no payments can be made after December 31 2021. Based On Circumstances You May Already Qualify For Tax Relief.

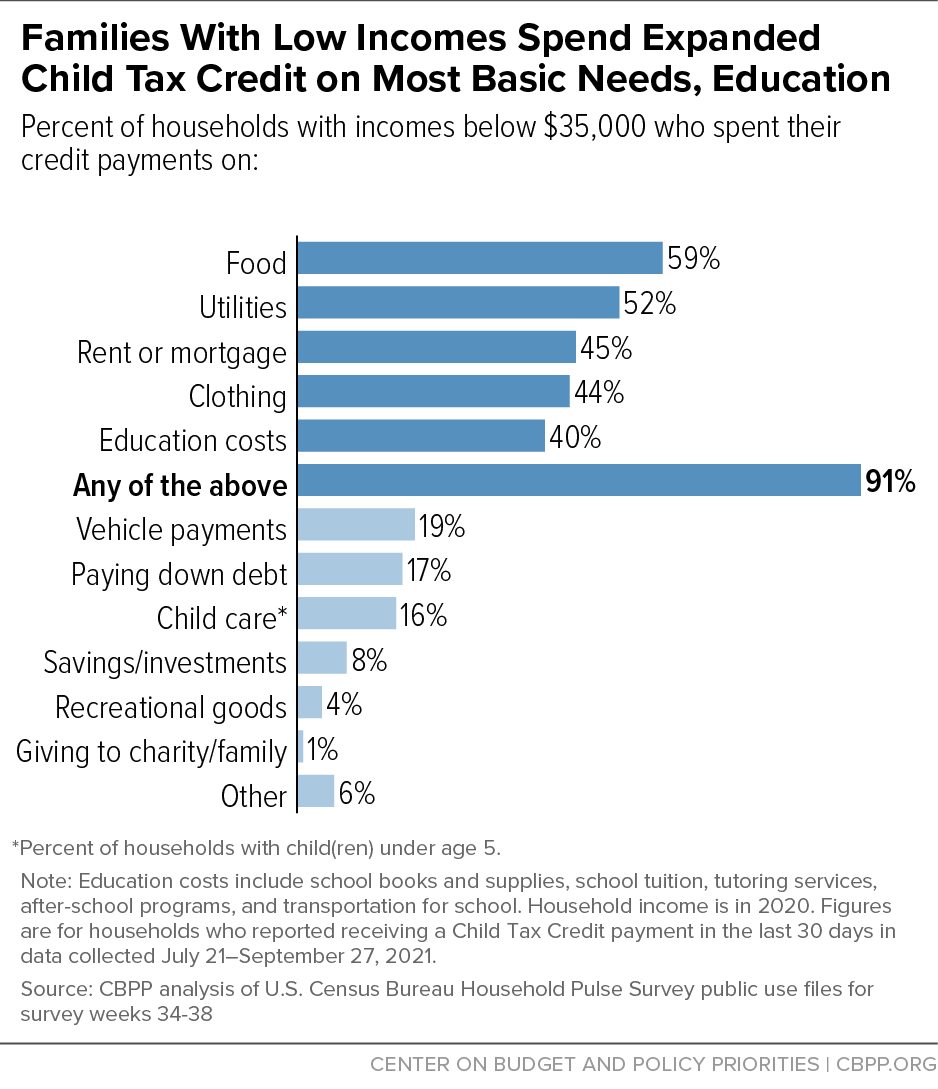

Those who opted out of all. The plan raised the existing child tax credit from 2000 to up to 3600 per child for ages 5 and younger and 3000 for each child aged 6-17. 15 Democratic leaders in Congress are working to extend the benefit into 2022.

Child tax credit payments will revert to 2000 this year for eligible taxpayers credit. And while the final monthly payment of 2021 went out Dec. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. Here is what you need to know about the future of the child tax credit in 2022. If you didnt receive one or more monthly advance Child Tax Credit payments in 2021 for a qualifying child you can still receive those payments and the remaining amount of your credit by claiming the Child Tax Credit for that child when you file a 2021 tax return during the 2022 tax filing season.

We dont make judgments or prescribe specific policies. Now even before those monthly child tax credit advances run out the final two payments come on Nov. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Lawmakers havent given up on the fight for more expanded Child Tax Credit payments in 2022. In 2022 the tax credit could be refundable up to 1500 a rise from 1400 in 2020 due to inflation.

Those who opted out of all the monthly payments can expect a 3000 or 3600. The benefit for the 2021 year. There May Still Be Hope for Monthly Child Tax Credit Payments in 2022.

15 there is still more of that money coming to Americans in 2022. Congress fails to renew the advance Child Tax Credit payments which would have been part of the Build Back Better Act and the payments expire. But this may not preclude these payments.

The 2022 child tax credit is set to revert back to 2000 for each dependent age 17 or younger. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. Theres a plan to extend the credit but politics is getting in the way.

Advanced monthly payments totaled 300 per child under the age of 6 and 250 per child ages 6 to 17. The benefit for the 2021 year. I have written detailed articles covering FAQs for this payment but the main one being asked now is whether or not families will continue to get paid monthly in 2022 starting with the first payment on January 15 2022.

As it stands right now child tax credit payments wont continue into next year. Thats because only half the money came via the monthly installments. Ad Provide Tax Relief To Individuals and Families Through Convenient Referrals.

Family in the kitchen Increasing the maximum credit amount from 2000 to 3600 for children under.

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet

Non Filers Advance Child Tax Credit Payments In 2021 Legal Aid Of North Carolina

What Does The Democrats Proposed Extension Of The Child Tax Credit Have To Pass As Usa

Child Tax Credit Could Spur 1 5 Million Parents To Leave The Workforce Study Says Cbs News

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

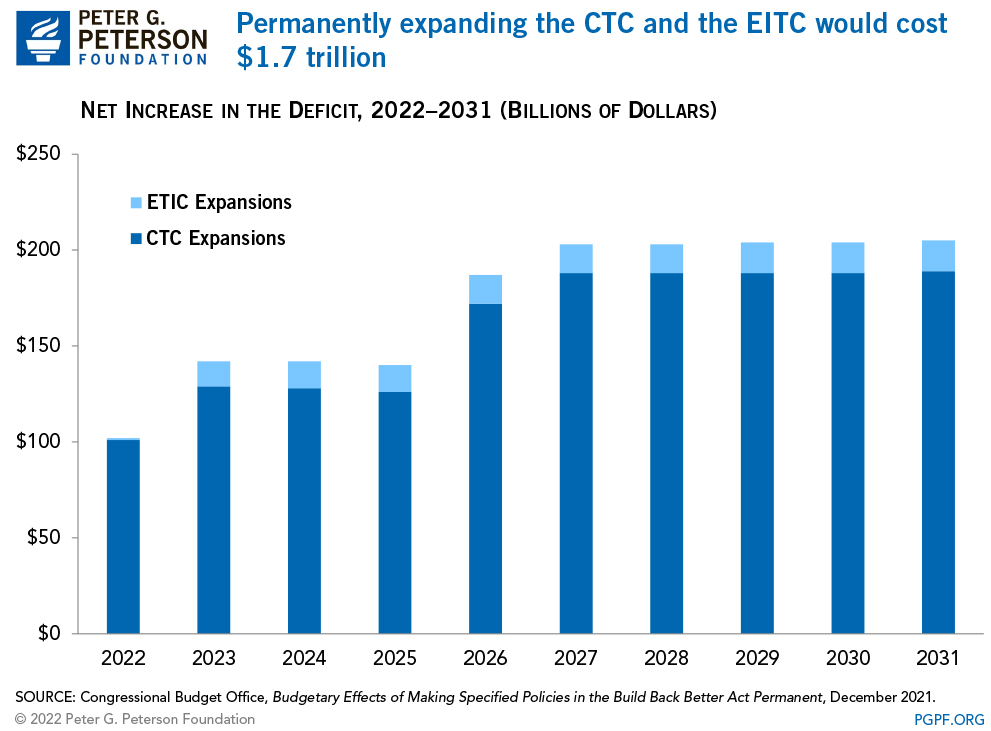

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Child Tax Credit How To Get Your Money If You Lost The Irs Letter Cnet

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

Here Is Why You May Need To Repay Your Child Tax Credit Payments Forbes Advisor

Possible Child Tax Credit In Vermont Could Give Families 1 000 Per Kid

September Child Tax Credit Payments Are Here What Happens If Irs Misses You Fingerlakes1 Com

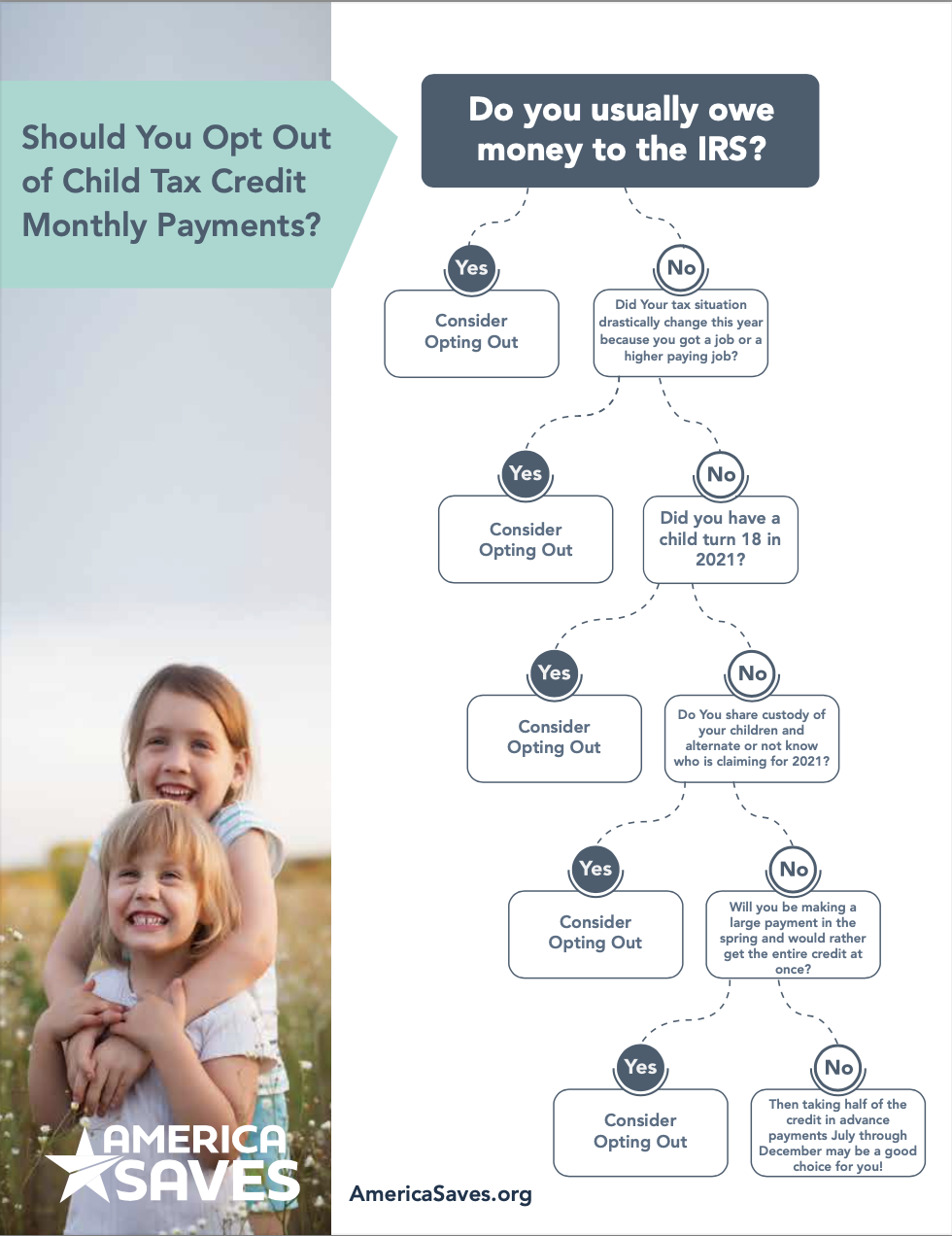

What You Need To Know About The 2021 Child Tax Credit Changes America Saves

What Are The Costs Of Permanently Expanding The Ctc And The Eitc

Missing A Child Tax Credit Payment Learn The Common Problems And How To Fix Them Cnet